10.1 The Importance of Financial Management in Small Business

LEARNING OBJECTIVES

- Understand the difference between accounting and finance for small businesses.

- Understand the major activities of finance.

- Understand how finance can affect the selection of a business form.

- Understand the various sources that can be used to finance the start-up operations of a business.

- Understand what factors might affect the extent to which a firm is financed by either debt or equity.

Chapter 9 “Accounting and Cash Flow” discusses the critical importance of a small business owner understanding the fundamentals of accounting—“the language of business.” This chapter examines finance and argues that the small business owner should acquire a basic understanding of some key principles in this discipline. One question that might come to someone’s mind immediately is as follows: “What is the difference between accounting and finance?” As an academic discipline, finance began in the early decades of the twentieth century. We have already seen that accounting predates the formal study of finance by millennia.“Difference between Accounting and Finance,” DifferenceBetween.net, accessed February 1, 2012, www.differencebetween.net/business/difference-between -accounting-and-finance. Yet some have argued that accounting should be seen as a subset of finance.“Difference between Accounting and Finance,” DifferenceBetween.net, accessed February 1, 2012, www.differencebetween.net/business/difference-between -accounting-and-finance. Others have argued that both accounting and finance should be seen as subdisciplines of economics. Not surprisingly, others have argued in favor of the primacy of accounting. If we get beyond this debate, we can see that accounting is involved with the precise reporting of the financial position of a firm through the financial statements, which is presented in Chapter 9 “Accounting and Cash Flow”. The accounting function is expected to collect, organize, and present financial information in a systematic fashion. Finance can be seen as “the science of money management” and consists of three major activities: financial planning, financial control, and financial decision making. Financial planning deals with the acquisition of adequate funds to maintain the operations of a business and making sure that funds are available when needed. Control seeks to assure that assets are being efficiently used. Decision making is associated with determining how to acquire funds, where to acquire funds, and how those funds should be used and within the context of the risk assessment of the aforementioned decisions. As an academic discipline, finance has grown tremendously over the last four decades.

Much of the work produced during this period possessed both an esoteric analytical quality and profound practical consequences. One only has to look at newspapers and the business press, during the last few years, to see how financial theory (efficient market hypothesis) and financial models (options pricing, derivatives, and arbitrage models) have played a dominant role in the global economy. Fortunately, most small businesses have no need to directly involve themselves with these analytical abstractions. But this does not mean that small business owners do not need to concern themselves with fundamental issues of financing their firms.

Impact of Organization Type on Finance Decisions

Selecting the form of business organization that is adopted by a business depends on many factors. One could begin by anticipating the eventual size and nature of the business.“Types of Business Organizations,” BusinessFinance.com, accessed December 2, 2011, www.businessfinance.com/books/startabusiness/startabusinessworkbook010.htm. The complexity of a business may dictate the type of business organization that is adopted. However, many of the factors that go into this determination are either directly or indirectly financial in nature. The indirect factors are as follows: the extent to which a business owner wishes to attain control of the business, the relationship that the owner would have with partners or investors, and the perceived risk associated with the business. This last factor is tied to the question of the extent to which the owner will invest his or her own money and assets. The direct financial factors that go into selecting the type of the business organization include the following: expected profits or losses, tax issues, the vulnerability and threat from lawsuits, and the ability to extract profits from the business for the owner’s use. The federal government recognizes six forms of business organizations for tax purposes: sole proprietorship, partnership, C-corporation, S-corporation, trust, and nonprofit. The last two are unlikely to be adopted by small businesses. It is useful to examine the financial implications of organizing along the remaining four basic formats.

Sole Proprietorship

Many small businesses operated by a single individual adopt sole proprietorship format of business organization. It is the most basic type of business organization. It is also the least expensive to create and the easiest to operate and dissolve. Sole proprietorships can be incorporated if the owner so desires. Not being a legal entity, single scratch sole proprietorships disappear after the death of the owner. This type of business is essentially a format for a single-person business (although many have between one and ten employees), where the owner makes all the decisions related to the business’s operations. The owner can extract all profits from the business for his or her personal use, or the owner can decide to reinvest any portion of the profits back into the business. It is interesting to know that 70 percent of all businesses in the United States are sole proprietorships yet they only produce 20 percent of all the nation’s profits.“Business Finance—by Category,” About.com, accessed December 2, 2011, bizfinance.about.com/od/income tax/a/busorgs.htm. Because a single proprietorship is not a legal entity, any income generated by the business goes directly on the owner’s personal tax return. However, the single owner is also personally responsible for any debts that the business acquires. This means that the owner may put his or her own personal assets at risk. In addition, this business organization means unlimited liability for its owner. The format means that there is very little opportunity to raise funds from sources other than the owner’s own capital or consumer loans.

Partnerships

Partnerships generally are unincorporated businesses. From a financial standpoint, partnerships offer a few advantages over sole proprietorship. By having more than one owner (investor), it is often easier to raise additional capital. In some businesses, such as law firms and accounting firms, the prospect of becoming a partner may be an attractive inducement to gain employees. There are several versions of partnerships.

The general partnership is composed of two or more owners who contribute the initial capital of the business and share in the profits and any losses. It is similar to a sole proprietorship in that all partners are personally responsible for all the debts and the liabilities of the business. A general partnership is comparable to a sole proprietorship in that neither is a taxable entity; therefore, the partners’ profits are taxed as personal income. They can deduct any business losses from their personal income taxes. The exact proportion of ownership of the firm is generally found in a written document known as the partnership agreement.

A limited partnership is a business that may have several general partners and several more limited partners. The major difference with a general partnership is that the limited partners do not have unlimited liability. Their losses are limited to their original investment in the business. Common practice means that these limited partners do not play a major decision-making role in the life of the business.

C-Corporations

Selecting a C-corporation form of business entails more effort and expense in creating this format. Corporations must be chartered by the state in which they are headquartered. Corporations are viewed as legal entities, meaning that they can enter into legal agreements with individuals and other corporations. They are also subject to numerous local and state regulations. This often results in extensive paperwork that can be costly. Corporations are owned by their shareholders. The shareholders are liable only for their original investment in the business. They cannot be sued for more than that amount. One of the major advantages of adopting a corporate format is that in this type of business, it is sometimes much easier to raise capital through either debt or the issuance of stock. Profits derived from this type of business are taxed at the corporate rate. It is important to note that dividends paid to shareholders, unlike interest expenses, are not deductible. So in a real sense, this form of income is doubly taxed.

S-Corporations

The S-corporation is a special format designed to eliminate the problem of double taxation that one might find with a C-corporation format. It first differs from a C-corporation in that it is limited to a hundred shareholders, although it can be created with just one shareholder. If a shareholder is an employee of the business and contributes any service to the business, then the corporation is required to pay that individual a salary. The term that is used is “reasonable” salary. This definition may vary under several conditions. A failure to comply with this ambiguous definition of “reasonable” salary means that the IRS can reclassify the profits as wages and tax the amount at the personal income rate.

Limited Liability Company

A limited liability company is an organizational form that can be limited to a single individual or several other owners or shareholders. Like a general partnership, there is a requirement for documents that define the distribution of responsibilities, profits, or losses. Generally, the members of a limited liability company are liable for the debts of the company. This format may provide tax and financial benefits for the participants. This format cannot be used in the banking or insurance industries.

Acquisition of Funds

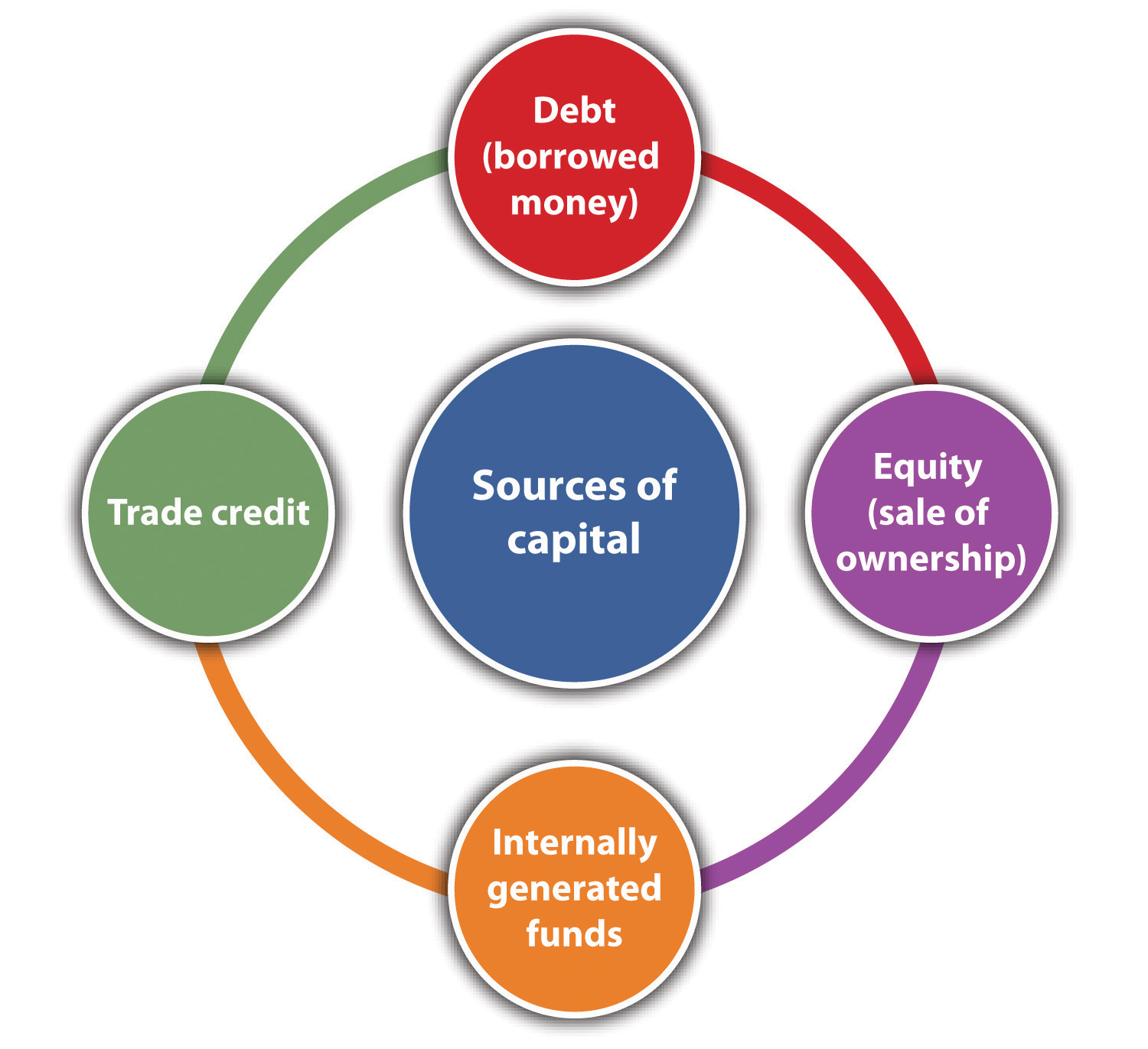

Capital is the lifeblood of all businesses. It is needed to start, operate, and expand a business. Capital comes from several sources: equity, debt, internally generated funds, and trade credits (see Figure 10.1 “Sources of Capital”).

Figure 10.1 Sources of Capital

Equity financing raises money by selling a certain share of the ownership of the business. It involves no explicit obligation or expectation, on the part of the investors, to be repaid their investment. The value of equity financing lies in the partial ownership of the business.

Perhaps the major source of equity financing for most small start-up businesses comes from personal savings. The term bootstrapping refers to using personal, family, or friends’ money to start a business.“Financing,” Small Business Notes, accessed December 2, 2011, www.smallbusinessnotes.com/business-finances/financing. The use of one’s own money (or that of family and friends) is a strong indicator that a business owner has a strong commitment to and belief in the success of the business. If a business is financed totally from one’s personal savings, that means the owner or the operator has total control of the business.

If a business is structured as a corporation, it may issue stock. Generally, two major types of stock may be issued: common stock and preferred stock. It should be noted that in most cases, owners of common stock have what are known as voting rights. They have a proportional vote (directly related to the number of shares they own) for members of the board of directors. Preferred stock does not carry with it voting rights, but it has a form of guaranteed dividend.

Corporations that issue stock must comply with several steps to meet both federal and state statutes, including the following: outlines to issue stock to shareholders, determining the price and number of shares to be issued, creating stock certificates; developing a record to record all stock transactions; and meeting all federal and state securities requirements.“Checklist: Issuing Stock,” San Francisco Chronicle, accessed December 2, 2011, allbusiness.sfgate.com/10809-1.html. Smaller businesses may choose to issue stock only to those who were involved in the initial investment of the business. In such cases, one generally does not have to register these securities with state or federal agencies. However, one may be required to fill out all the forms.“How to Form a Corporation,” Yahoo! Small Business Advisor, April 26, 2011, accessed February 1, 2012, smallbusiness.yahoo.com/advisor/how-to-form-a-corporation -201616320.html.

Chapter 5 “The Business Plan” discusses two sources of capital investment: venture capitalist and angel investors. Venture capitalists are looking for substantial returns on their initial investment—five, ten, sometimes even twenty-five times their original investment. They will be looking for firms that can rapidly generate significant profits or significant growth in sales. Angel investors may be more attracted to their interest in the small business concept than in reaping significant returns. This is not to say that they are not interested in recouping their original investment with some type of significant return. It is much more likely that angel investors, as compared to venture capitalists, will play a much more active role in the decision-making process of the small business.

One area for possible capital infusion into a small business may come from a surprising source. Many students (and some adults) may find funding to start up a business through business plan competitions. These competitions are often hosted by colleges and universities or small business associations. The capital investment may not be large, but it might be enough to start very small businesses.

Debt financing represents a legal obligation to repay the original debt plus interest. Most debt financing involves a fixed payment schedule to repay both principal and interest. A failure to meet the schedule has serious consequences, which might include the bankruptcy of the business. Those who provide debt financing expect that the principal will be repaid with interest, but they are not formal investors in the business.

There are numerous sources for debt financing. Some small businesses begin with financing by borrowing from friends and family. Some firms may choose to finance business operations by using either personal or corporate credit cards. This approach to financing can be extraordinarily expensive given the interest rates charged on credit cards and the possibility that the credit card companies may change (by a significant amount) the credit limit associated with the credit card.

The largest source of debt financing for small businesses in the United States comes from commercial banks.“How Will a Credit Crunch Affect Small Business Finance?,” Federal Reserve Bank of San Francisco, March 6, 2009, accessed December 2, 2011, www.frbsf.org/publications/economics/letter/2009/el2009-09.html. Bank lending can take many forms. The most common loan specifies the amount of money to be repaid within a specific time frame for a specific interest rate. These loans can be either secured or unsecured. Secured loans involve pledging some assets—such as a home, real estate, machinery, and plant—as collateral. Unsecured loans provide no such collateral. Because they are riskier for the bank, they generally have higher interest rates. For a more comprehensive discussion of bank loans, see Section 10.2.1 “Relationships with Bank and Bankers”.

The Small Business Administration (SBA) has a large number of programs designed to help small businesses. These include the business loan programs, investment programs, and bonding programs. The SBA operates three different loan programs. It should be understood that the SBA does not make the loan itself to a small business but rather guarantees a portion of the loan to its partners that include private lenders, microlending institutions, and community development organizations. To secure one of these loans, the borrower must meet criteria set forth by the SBA. It should be recognized that these SBA loan rules and guidelines can be altered by the US Congress and are dependent on prevailing economic and political conditions. The following subsections briefly describe some of the loan programs used by the SBA.

(a) Loan Programs

This class of loans may be used for a variety of reasons, including the purchase of land, buildings, equipment, machinery, supplies, or materials. It may also be used for long-term working capital (paying accounts payable or the purchase of inventory). It may even be used to purchase an existing business. This class of loans cannot, however, be used to refinance existing debt, to pay delinquent taxes, or to change business ownership.

- Special-purpose loans program. These loans are designed to assist small businesses for specific purposes. They have been used to help small businesses purchase and incorporate pollution control systems, develop employee stock ownership plans, and aid companies negatively impacted by the North American Free Trade Agreement (NAFTA). It includes programs such as the CAPLines, which provide assistance to businesses for meeting their short-term working capital needs. There is also the Community Adjustment and Investment Program. This program is designed to assist businesses that might have been adversely impacted by NAFTA.

- Express and pilot programs. These loan programs are designed to accelerate the process of providing loans. SBA Express can respond to a loan application within thirty-six hours while also providing lower interest rates.

- Community express programs. These programs are designed to assist borrowers whose businesses are located in economically depressed regions of the country.

- Patriot express loans. These loans are designed to assist members of the US military who wish to create or expand a small business. These loans have lower interest rates and can be used for starting a business, real estate purchases, working capital, expansions, and helping the business if the owner should be deployed.

Export loan programs. Given the remarkable fact that 70 percent of American exporters have less than twenty employees, it is not surprising that the SBA makes a special effort to support these businesses by providing specialized loan programs. These programs include the following:

- Export Express Program. This program has a rapid turnaround time to support export-based activities. It can provide for funds up to $500,000 worth of financing. Financing can be either a term loan or a line of credit.

- Export Working Capital Program. A major challenge that small exporters face is the fact that many American banks will not provide working capital advances on orders, receivables, or even letters of credit. This SBA program assures up to the 90 percent of a loan so as to enhance a business’s export working capital.

- SBA and Ex-Im Bank Coguarantee Program. This is an extension of the Export Working Capital Program and deals with expanding a business’s export working capital lines up to $2 million.

- International Trade Loan Program. This program, with a maximum guarantee of $1.75 million, enables small businesses to start an exporting program, enlarge an exporting program, or deal with the consequences of competition from overseas imports.

Another source of debt financing is the issuance of bonds. Bonds are promissory notes. There are many forms of bonds, and here we discuss only the most basic type. The fundamental format of the bond is that it is a debt instrument that promises to repay a fixed amount of money within a given time frame while providing interest payments on a regular basis. The issuance of bonds is generally an option available to businesses with a corporation format. It also requires extensive legal and financial preparations.

Another source of capital is the generation of internal funding. This simply means that a business plows its retained earnings back into the business. This is a viable source of capital when a business is highly profitable.

The last source of capital is trade credit. Trade credit involves purchasing supplies or equipment through financing made available by vendors. This approach may allow someone to acquire inventory of materials and supplies without having the full price at the time of purchase. Some analysts say that trade credit is the second largest source of financing for small businesses after borrowing from banks.Anita Campbell, “Trade Credit: What It Is and Why You Should Pay Attention,” Small Business Trends, May 11, 2009, accessed December 2, 2011, smallbiztrends.com/2009/05/trade-credit-what-it-is-and-why-you-should-pay-attention.html. Trade credit is often a vital way of securing supplies.

Trade credit is often expressed in terms of three important numbers—a discount rate, the number of days for one to pay to qualify for the discount, and the number of days on which the bill must be paid. As an example, a trade credit offered by a supplier might be listed as 5/5/30. This translates into a 5 percent discount if the bill is paid within five days of the issuance. The third number means that the bill must be paid in full within thirty days.

Video Clip 10.1

How to Raise Capital: The #1 Skill of an Entrepreneur

Describes what an entrepreneur needs to do in order to acquire capital for the firm.

Video Clip 10.2

Pat Gage: Getting Business Financing for a Small Business

Voice-over PowerPoint identifies where a small business owner can acquire funding.

Video Clip 10.3

How to Finance a Business: How to Get Start-Up Business Financing

Examines the use of bank financing for the small business.

Video Clip 10.4

Financing a New Business: How to Find Government Small Business Grants

Locate places to find small business grants through search engines with ideas from a certified public accountant in this free video on new business financing.

Video Clip 10.5

The Role of Credit Cards in Small Business Financing

Congressional testimony that warns of the use of using credit cards to finance small businesses.

Video Clip 10.6

Financial Analysis for Small-Business Owners

This excerpt from the popular video learning series at BusinessBuffet.com introduces the core concepts behind financial analysis for small business.

Web Resources

Financing Small Business Portal

Discusses financing opportunities.

Credit Loans for Small Businesses

The Chase portal—one provider of loans for small businesses.

www.chase.com/index.jsp?pg_name=ccpmapp/smallbusiness/credit_loans/page/bb_lending

Five Ways to Finance a Business in Difficult Financial Times

Alternative ways of financing when banks are not lending.

biztaxlaw.about.com/od/financingyourstartup/tp/financingsmallbiz.htm

Capital Structure: Debt versus Equity

A critical component of financial planning for any business is determining the extent to which a firm will be financed by debt and by equity. This decision determines the financial leverage of a business. Many factors enter into this decision, particularly for the small business. From the classic economic and finance perspective, one should evaluate the cost of both debt and equity. Debt’s cost centers largely on the interest rate associated with a specific debt. Equity’s cost includes ceding control to other equity partners, the cost of issuing stock, and dividend payments. One should also consider the fact that the interest payment on debt is deductible and therefore will lower a business’s tax bill.Gavin Cassar, “The Financing of Business Startups,” Journal of Business Venturing 19 (2004): 261–83. Neither the cost of issuing stock nor dividend payments is tax deductible.

Larger businesses have many more options available to them than smaller enterprises. Although this is not always true, larger businesses can often arrange for larger loans at more favorable rates than smaller businesses.Lola Fabowale, Barbara Orse, and Alan Riding, “Gender, Structural Factors, and Credit Terms between Canadian Small Businesses and Financial Institutions,” Entrepreneurship Theory and Practice 19 (1995): 41–65. Larger businesses often find it easier to raise capital through the issuance of stock (equity).

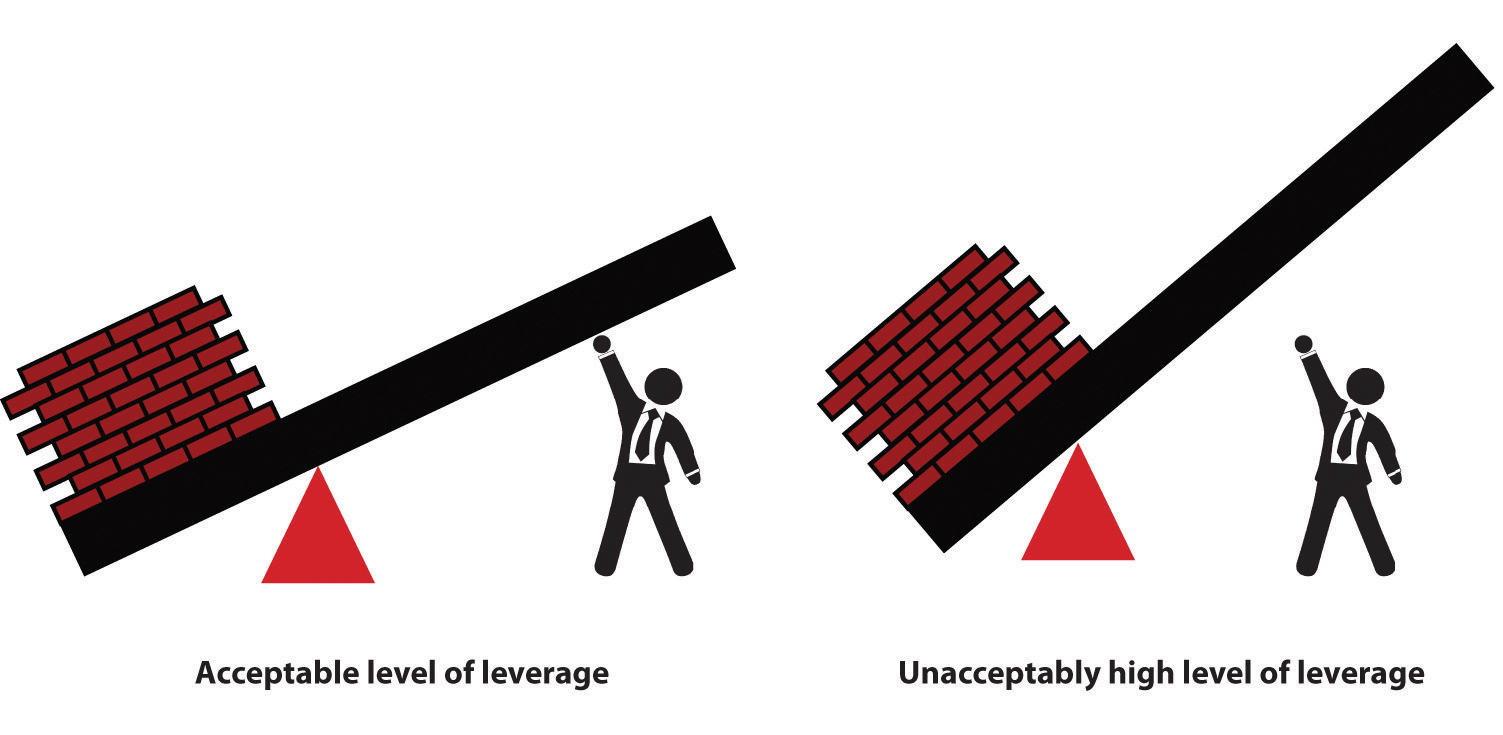

By increasing a business’s proportion of debt, its financial leverage can be increased. There are many reasons for attempting to increase a business’s financial leverage. First, one is growing the business with someone else’s money. Second, there is the deductible nature of interest on debt. Third, as more clearly shown in Section 10.3.2 “Capital Structure Issues in Practice”, increasing one’s financial leverage can have a positive impact on the business’s return on equity. For all these benefits, however, there is the inescapable fact that increasing a business’s debt level also increases a business’s overall risk. The term financial leverage can be seen as being comparable to the base word—lever. Levers are tools that can amplify an individual’s power. A certain level of debt can amplify the “lifting” power of a business (see the upper portion of Figure 10.2 “Acceptable and Unacceptable Levels of Leverage”). However, beyond a certain point, the debt may be out of reach, and therefore the entire lifting power of financial leverage may be lost (see the lower portion of Figure 10.2 “Acceptable and Unacceptable Levels of Leverage”). Beyond the loss of lifting power, the assumption of too much debt may lead to an inability to pay the interest on the debt. This situation becomes the classic case of filing for Chapter 1 “Foundations for Small Business”1 bankruptcy.

Figure 10.2 Acceptable and Unacceptable Levels of Leverage

This major issue for small businesses—determining how to raise funds through either debt or equity—often transcends economic or financial decisions. For many small business owners, the ideal way of financing business growth is through generating internal funds. This means that a business does not have to acquire debt but has generated sufficient profits from its operations. Unfortunately, many small businesses, particularly at the beginning, cannot generate sufficient internal funds to finance areas such as product development, the acquisition of new machinery, or market expansions. These businesses have to rely on securing additional capital debt, equity, or some combination of both.

Many individuals start small businesses with the express purpose of finding independence and control over their own economic and business lives. This desire for independence may make many small business owners averse to the idea of equity financing because that might mean ceding business control to equity partners.Harry Sapienza, M. Audrey Korsgaard, and Daniel Forbes, “The Self-Determination Mode of an Entrepreneur’s Choice of Financing,” in Advances in Entrepreneurship, Firm Emergence, and Growth: Cognitive Approaches to Entrepreneurship Research, ed. Jerome A. Katz and Dean Shepherd (Oxford: Elsevier JAI, 2003) 6:105–38. Another issue that makes some small business owners averse to acquiring additional equity partners is the simple fact that the acquisition of these partners means less profit to the business owner. This factor in the control issue must be considered when the small business owner is looking to raise additional capital through venture capitalist and angel investors.Allen N. Berger and Gregory F. Udell, “The Economics of Small Business Finance: The Roles of Private Equity and Debt Markets in the Financial Growth Cycle,” Journal of Banking and Finance 22, no. 6–8 (1998): 613–73.

A recent research paperRowena Ortiz-Walters and Mark Gius, “Performance of Newly Formed Micro Firms: The Role of Capital Financing Structure and Entrepreneurs’ Personal Characteristics” (unpublished manuscript), 2011. examined the relationship between profitability and sources of financing for firms that had fewer than twenty-five employees. It found several rather interesting results:

- Firms that use only equity have a low probability of being profitable compared to firms that use only business or personal debt.

- Firms owned by females and minority members relied less on personal debt than male and minority owners.

- Female owners will be more likely to rely on equity from friends and family than their male counterparts.

- Firms that rely exclusively on personal savings to finance business operations will more likely be profitable than firms using equity forms of debt.

Web Resources

Capital Structure

Definition and explanation of capital structure.

www.enotes.com/capital-structure-reference/capital-structure-178334

Capital Structure from an Investor’s Perspective

This reviews how an investor would interpret a business’s capital structure.

beginnersinvest.about.com/od/financialratio/a/capital-structure.htm

KEY TAKEAWAYS

- Business owner must be aware of the implications of financing their firms.

- Owners should be aware of the financial and tax implications of the various forms of business organizations.

- Business owners should be aware of the impact of financing their firms through equity, debt, internally generated funds, and trade credit.

- Small-business owners should be aware of the various loans, grants, and bond opportunities offered by the SBA. They should also be aware of the restrictions associated with these programs.

EXERCISES

- Interview the owners of five local businesses and ask them what business organizational format they use and why they adopted that form.

- Ask them how they initially financed the start-up of their businesses.

- Ask these same owners how they prefer to finance the firm. (Note that most owners will probably not want to go into any detail about the financial operations of their businesses.)

- Ask them if they have had any experience with any SBA loan program and if they have any reactions to these programs.